2020 Co-Investment Survey Results

EXECUTIVE SUMMARY

Survey suggests the litigation finance industry has demand for co-investment capital

Speed to commitment and having a fully funded commitment ranked highest in terms of co-investor characteristics

Most funders expect a co-investment commitment within less than 4 weeks

INVESTOR INSIGHTS

While investors might be attracted to co-investment opportunities, diversification is a strong component to successful long-term investing in commercial litigation finance

Co-investing should only be considered in the context of creating a portfolio or to add specific exposures to an existing portfolio, but should never be viewed as a single investment

Slingshot Capital and Litigation Finance Journal recently undertook a survey of commercial litigation finance participants to obtain a deeper understanding of the extent to which there is demand for third-party co-investment capital.

The survey was distributed globally, with the majority of responses coming from constituents in the USA (50%) and UK (18%) markets or from funders that invested globally (18%). Of the responses, 22% were from advisors/intermediaries and 78% were from funders (with the vast majority of funders having dedicated litigation finance funds).

Co-Investment in Litigation Finance

Co-investment opportunities are an attractive sub-set of opportunities for many investors in a variety of asset classes, with particular appeal for private equity (buy-out, growth equity, real estate and venture capital) asset classes. However, in the context of litigation finance, an investor needs to take a different perspective when it considers co-investment opportunities.

Whereas it may be perfectly acceptable for a family office, endowment or pension plan to co-invest in a specific private equity opportunity as part of their larger portfolio, the quasi-binary nature of litigation finance should make investors think twice about how they approach investing in litigation finance. The main difference being in the probability weighted set of outcomes accorded each asset class. In a private equity buy-out transaction, a high number of them produce positive results and the results will vary across a spectrum of potential return outcomes (from 1+ X original investment to a 5+ X the original investment). In litigation finance, even though many cases tend to settle before going to court, there tends to be two outcomes – a win or a loss. The wins are across a tighter spectrum than private equity and the losses tend to be absolute (with exceptions). Accordingly, due to the quasi-binary nature of the outcomes of litigation finance, co-investing should only be considered where the investors are committed to assembling a portfolio of such co-investment opportunities and have the ability to assess the fundamental aspects of litigation finance. Alternatively, to the extent an investor has existing investments in litigation finance but is looking to round out its portfolio with specific case exposures to achieve a particular portfolio objective then co-investment opportunities may play a role in that investor’s portfolio construction approach.

A snapshot of the 2020 Co-Investment Survey results are summarized below:

Demand

Of the 23 respondents, 70% stated they had a need for co-investment capital, whereas 30% did not. However, 13% indicated that the need for co-investment was occasional and that sometimes their LPs had pre-emptive rights with respect to investing in those opportunities.

Frequency

In terms of frequency of co-investment opportunities, almost 50% of respondents indicated they have from 1 to 5 opportunities in a given year, with just over 20% in the 6-10 range and a few managers indicating they had 20 such opportunities in a given year. The number of opportunities directly correlated with the size of the funder and the size of the cases they typically finance.

Co-Investor Characteristics

As regards the characteristics that are most important in a co-investment partner, speed to commitment and having a funded capital source ranked the highest, with responsiveness and understanding complex litigation also ranking highly. However, there was not a huge dispersion in terms of the importance of the 6 criteria listed, suggesting that all criteria were factored into their decision-making process. Keep in mind that the compilation of the rankings below are an average of the rankings of the 6 criteria and so a low number should be viewed as being less important whereas a high number should be viewed as more important (i.e. this is the inverse of the number ranking system used in the survey question itself).

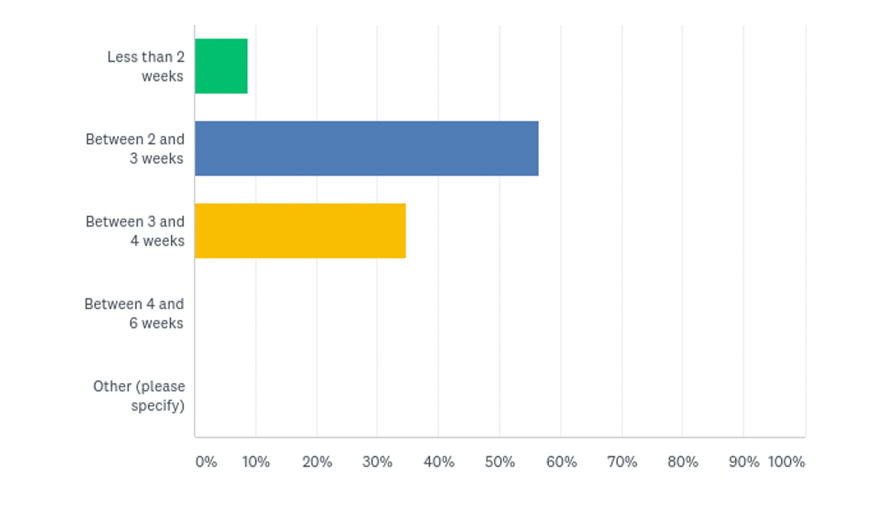

When we dive further into the ‘speed to commitment’ characteristic, we find the vast majority of respondents expect a commitment within 3-4 weeks. It remains to be seen if expectations and reality are in alignment, a good question to include in the next survey.

Expected Duration

With respect to the underwritten expected duration, most fall within the 12-36 month range, which is consistent with duration expectations for the industry as a whole. However, 30% of respondents did indicate that duration was a function of the type of case being underwritten, with certain case types (patent, international arbitration, etc.) having longer durations and appeal cases having shorter durations.

Co-Investment Structuring

In terms of insight into how these co-investment transactions were typically structured, the responses varied. In the ‘other’ category some respondents had indicated they have used a variety of the choices offered whereas one respondent stated that they received a specified interest in the profits produced by the investment

Current Co-Investors

As it relates to where the current co-investment opportunities are being offered, the majority were offer to other funders suggesting there is a fair amount of co-opetition in the litigation finance marketplace. However, within the ‘other’ category most respondents suggested it was a combination of all of the choices listed.

This brings to a close the results of our first commercial litigation finance co-investment survey. Slingshot Capital and Litigation Finance Journal would like to thank those that participated in the survey for their time and feedback.

Our next survey will cover fundraising initiatives by fund managers in the commercial litigation finance sector. We anticipate making the fundraising survey an annual survey so that we can track fundraising activities over time.

If you would like to participate in future surveys, please contact Ed Truant here to register your interest.