Portfolio Theory in the Context of Litigation Finance (3 of 2?)

Executive Summary

Litigation finance is a non-correlated asset class which produces strong absolute returns, and one in which it is difficult to lose money when applying portfolio theory

Diversification of a portfolio can mitigate the impact of unsystematic risks on portfolio performance - although, it depends on its composition of assets

A change in the outcome of a single case can have a significant impact on portfolio performance in a concentrated portfolio

Exceeding concentration limits essentially allows investment manager bias to enter the portfolio, which should be avoided

Slingshot Insights:

With a 70% win rate, the commercial litigation finance asset class is a difficult one in which to lose money, assuming you have a well-constructed and diversified portfolio.

Portfolio theory is important to the commercial litigation finance asset class due to its inherently high level of unsystematic risks

Slingshot’s Rule of Thumb: a portfolio should contain no less than 20 investments in order to provide the benefits associated with portfolio theory

Diversification is critical for every fund manager

Diversification provides optionality for an under-performing manager to ‘live to fight another day’ if their first fund achieved sub-par performance

Part 3 of 2? Wait, what?

Let me explain. As a result of the prior two articles concerning portfolio theory in the context of litigation finance, which can be found here (part 1) and here (part 2), I received interest from readers asking me to provide numeric examples to illustrate the points in the article with respect to portfolio construction and concentration limits.

Accordingly, I have created some simplified models to apply mathematics to the concepts. If you would like a copy of the financial models, please email me and I will send them to you, as they may be beneficial for investors to understand the value of portfolio construction, and investment managers to better understand the financial implications of their portfolio construction decisions.

Asset Class Perspective

Before diving into the spreadsheets and analyses, it is important to put the litigation finance asset class into perspective. As an asset class that is considered “esoteric” or “an alternative alternative” or “exhibiting insurance type characteristics”, the asset class itself suffers from classification anxiety, given that it is a relatively new and niche asset class with different investors classifying it differently. I would say first and foremost that I believe commercial litigation finance is an equity asset class, even though credit hedge funds have decided to invest in the asset class (as contrasted with consumer litigation finance (personal injury) which, as a result of its diverse nature and high success rate, tends to exhibit more credit like qualities).

Investors who invest in private equity would understand the characteristics of the asset class, despite the fact that the economics are driven by a different underlying source, and would appreciate that the duration is about half that of private equity. Where private equity funds have 5-year investment periods and 10-year terms, commercial litigation finance tends to have 2-3 year investment periods and 5-year terms, which emanates from an average duration of about 30 months per case (with duration differences relating to size, jurisdiction and case type).

The other significant aspect of commercial litigation finance is that it is a non-correlated asset class, meaning that the value of litigation finance claims is not derived from or influenced by traditional asset pricing mechanisms like the stock markets, and does not tend to move with fluctuations in the economy. The outcome of the litigation underlying the investment is considered idiosyncratic to the case itself and is not dependent on other exogenous economic factors. Although, one could argue that in times of financial dislocation (like we are seeing in the current financial markets), the value of a piece of litigation may be impacted by people’s perceptions about asset prices in general (i.e. a $20 million damages claim in frothy times may equate to a $10 million damages claim when there is an element of financial pressure being applied). On the flip side, when corporations are experiencing financial pressure, they may look to litigation to create value by pursuing litigation that may have otherwise gone unnoticed or not prioritized by the management team. In the event a corporation is involved in a piece of litigation, they may be more inclined to settle at a lower amount and move on to shore up their balance sheets. It is difficult to forecast how all of this shakes out from an industry perspective, but we may be in a unique period that will allow us to test our theories.

The binary nature of litigation has kept many potential investors on the sidelines as they view the asset class as being difficult to forecast. The reality is that most litigation (i.e. 90-95%) gets settled before it reaches the courtroom steps, hence the binary element of judicial outcomes is not typically relevant. In certain case types, such as class action securities claims, the case type has an extremely high settlement rate in certain jurisdictions once the case has been certified by the court. The certification process is a fairly high standard of proof that the court requires the plaintiff to show before it will consider hearing the case, hence it is viewed as a strong indicator by all parties that the ‘writing is on the wall’ with respect to the viability of the case; so the defence is likely to settle before the case goes to trial. Similarly, in patent disputes, if the plaintiff passes through an Inter Partes Review process, there is an increasing chance of settlement. Accordingly, one needs to understand the litigation process and psychological and economic impacts thereof before one can conclude about the prospects of a case or portfolio. Investors should understand the potential for binary risk in a portfolio before jumping to conclusions about its potential effect on outcomes.

Accordingly, for investors that are comfortable with private equity type exposures, who are used to capital call type commitments and the nature of illiquid investments, who are looking for non-correlated exposures in their otherwise highly-correlated portfolios, and who are looking for return profiles that are the same or better than most of the top performing private equity managers, commercial litigation finance is an increasingly popular alternative. While still in the early stages of its development, those institutions that have invested have continued to re-invest in the asset class. As long as you apply a responsible approach to portfolio construction, the asset class stresses quite nicely with a 70% win ratio, underwriting at a 2.5 - 3.5 multiple of invested capital, and a 30-month duration, although outliers (in duration and multiples of capital) may have an impact on overall returns.

The Analytical Approach

It is not necessary to develop a large number of assumptions to illustrate the points made, but it is important to understand a few concepts.

First, based on the hundreds of realized case results I have reviewed, I estimate the average win rate across the industry (large and small, across different jurisdictions and inclusive of all case types), at about 70%. That is to say, 70% of the time the case concludes favourably and it produces a profit for the funder (not just the return of all or a portion of principal, but an actual profit). Which means the remaining 30% of the time a loss is produced (these include full and partial losses, and withdrawals). Keep in mind that while realized cases are a reliable source of data because they contain finalized results, they are not representative of a portfolio, because by definition, they do not contain estimates of values of unrealized cases. Accordingly, one could rightly conclude that the results are inherently skewed. Nevertheless, it is a fair assumption for purposes of the following analyses as it is the best and most reliable information on which to generate analyses.

Secondly, deployment rates across the industry vary significantly, and so while I assume deployment rates are equal to commitment amounts (deployment rates being the amount of money actually invested in a case as a percent of the investment commitment amount made to the case), they may not be representative of the particular funder’s experience. Different strategies and different case types will inherently have different deployment rates.

Third, for the purpose of this analysis, I will assume there are no fees being charged by the manager in order to keep the math simple. Management fees will be addressed in an upcoming blog post.

Last, I will use specific assumptions about the portfolio in each set of analyses, as outlined in each scenario.

Scenario #1 – Value of Diversification

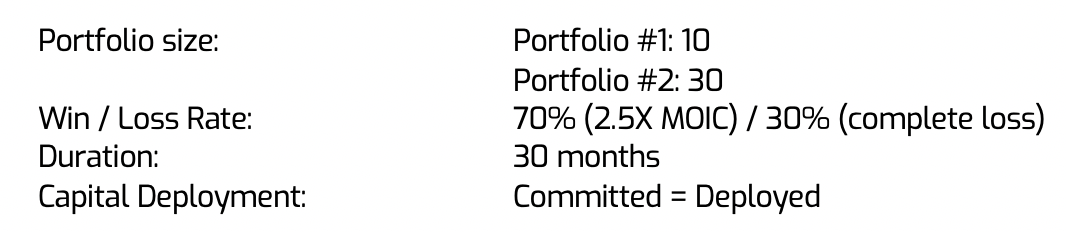

My first set of analyses will speak to the financial benefits of diversification, and I will illustrate this by comparing the results of a portfolio of 30 investments with the results of a portfolio of 10 investments in Scenario 1A. I will then adjust a single case outcome to determine its relative impact on returns in Scenario 1B, and the difference in the two scenarios will serve to highlight the benefits of diversification.

The following assumptions apply to Scenario #1:here (part 2)

In this scenario, I present two sets of analyses, comparing the results of a 30 case portfolio with those of a 10 case portfolio. If I keep all of the assumptions the same (Scenario 1A), it will likely come as no surprise that the Multiple of Invested Capital (MOIC) and Internal Rates of Return (IRR) are identical.

Conclusion: As long as the win rates across each portfolio are identical, the results will be identical regardless of how many investment are in the portfolio.

However, if I change only one of the cases from a win to a loss in each of the portfolios (illustrated in Scenario 1B), you will see there is a dramatic difference in overall portfolio results. So much so, that it should make any manager think twice or thrice about the size and distribution of their portfolio, as the differences in outcomes are significant on an absolute and relative basis.

Conclusion: If the manager's win rate is off by just one case win, it has a relatively punitive impact on the 10 case portfolio and a relatively negligible impact on the 30 case portfolio. To put this into perspective, this could be the difference between whether a manager earns a performance fee or not.

The results above illustrate that a change in a single case has a significant difference in the outcomes of the performance of the respective portfolios. The extent of the difference is outlined below, which is summarized by comparing the results of Portfolios #1 (less diversified portfolio) and #2 (more diversified portfolio) in the 1B scenario. These results are also directly correlated with the size of the relative portfolios where one is three times the size of the other, and has a similarly-sized relative impact in terms of performance. In both cases, the effect of changing a single case variable is over 300% greater in the concentrated portfolio when compared with the diversified portfolio.

1 Absolute difference is the mathematical difference in the outcome achieved between the two portfolios when you change a single case variable.

2 Relative difference is the comparison of the effect of the outcomes compared to one another.

Where this really should hit home for managers and investors alike is when it comes time to calculate the performance fee (or the manager’s “carried interest”). The size and composition of your portfolio, and any slight change in its outcome, may have a meaningful impact (either way) on whether – and to what extent – the manager participates in the performance of the fund through its carried interest mechanism. A manager could get lucky and have that single case settle in his or her favour, giving rise to a carried interest, but why take the chance? Diversify instead. If your investing methodology works, it will work just as well across a larger portfolio which reduces your carried interest risk. Managers should keep in mind that the entire investment team’s compensation may be significantly impacted by the performance fee, and a failure to construct appropriate portfolios may not only negatively impact results, but may also be fundamental to the longevity of the fund if the carried interest earners no longer trust the key decision maker’s ability to construct an appropriate low risk portfolio.

Scenario #2 – Danger of Inappropriate Concentration Limits

The second set of analyses will examine variations in concentration limits and exceptions thereto.

In scenario #2, we assume the portfolio consists of a subset of five concentrated cases (10% each, aggregating 50% of deployed capital) and 15 non-concentrated cases (aggregating 50% of deployed capital) with the 70/30 win/loss ratio applying to each component of the portfolio.

In Scenario 2A, we will examine the impact that the change in the outcome of a single case has on the portfolio performance by toggling case #4 from a win to a loss.

Conclusion: If the win rate of a portfolio that allows a concentration limit of 10%, assuming 5 investments hit the concentration limit, changes by one, then the portfolio performance changes significantly.

The rationale for this change in assumption is that if 70% of cases win on average, and you have five cases that hit your fund’s concentration limit, you cannot win 3.5 cases, and so your portfolio will statistically either win three or four of the five cases that hit your concentration limit (admittedly some liberties have been taken to segment the concentrated portfolio from the non-concentrated portfolio, as the win/loss ratio applies to the whole portfolio and not necessarily the artificially created subsets).

When we undertake this comparison, the following results indicate the significance the outcome of one concentrated case has on the outcome of the entire portfolio.

In analysis 2B, we determine the extent to which an exception to the concentration limits (assuming one 10% concentration is increased to 20%, and that particular case loses) could potentially affect the performance of the portfolio.

Conclusion: If the concentration of an individual case is exceeded and that case loses, then the portfolio performance is significantly negatively impacted.

In Scenario 2B, the following results occur:

You can see that allowing one case to double the concentration limit contributes to lower overall portfolio performance in the event of a loss. Accordingly, this analysis illustrates that managers should never exceed concentration limits (limits are put in place for a reason), because prudent portfolio construction would suggest that one would only do so if one had a very high confidence level that the particular case will be a winner, otherwise one is putting the entire portfolio’s performance at risk.

In an asset class that has idiosyncratic case risk (defendant risk, legal risk, precedent risk, etc.) and binary case outcome risk (if the case in fact goes to court), it is impossible for any manager to determine whether a particular case is a ‘slam dunk’, which is a necessary pre-condition for a manager to correctly conclude that he or she should exceed the concentration limit of any given case.

Slingshot Insights:

With a 70% win rate in litigation finance, the asset class is a difficult one in which to lose money when you consider the multiples of capital available to winning cases. However, this is possible only through a diversified portfolio.

Depending on the underlying strategy of the fund manager and its fund, the extent of diversification may vary. As an example, if I am running a patent litigation finance strategy, I know that patent litigation finance has generally fewer wins, but much greater volatility in outcomes with the potential for ‘home run’ outcomes. In this strategy, a larger portfolio with more exposures is appropriate due to the inherent volatility. On the other hand, if I am focused on smaller sized litigation finance claims, they generally have a shorter duration and lower volatility with a higher overall win rate, which means the portfolio can be relatively more concentrated without affecting the overall risk/reward characteristics of the portfolio. Either way, the examples above illustrate the impact concentrated portfolios have in general and why it is not in a manager’s best interest to ever exceed their own concentration limits unless they have near 100% certainty about the outcome of the specific case.